Looking for an Accountant that will help your business to

Pay Less Tax, Avoid Unnecessary Tax Penalties, Stay Tax Compliant

Here's What You'll Learn About Inside The Tax Video Mini - Course

(Watch The Video Below First)

Commonly overlooked tax law that allows you to use your personal car and home to REDUCE BUSINESS TAX

Simple tax laws that allow you to PAY LESS VAT even if your business is not registered for VAT. They are so simple, you can begin using them right away.

TAX SAVING TIPS for small and medium sized businesses in South Africa

All the different types of tax returns that your business is required to submit as well as the deadlines for submitting these tax returns

And much more...........

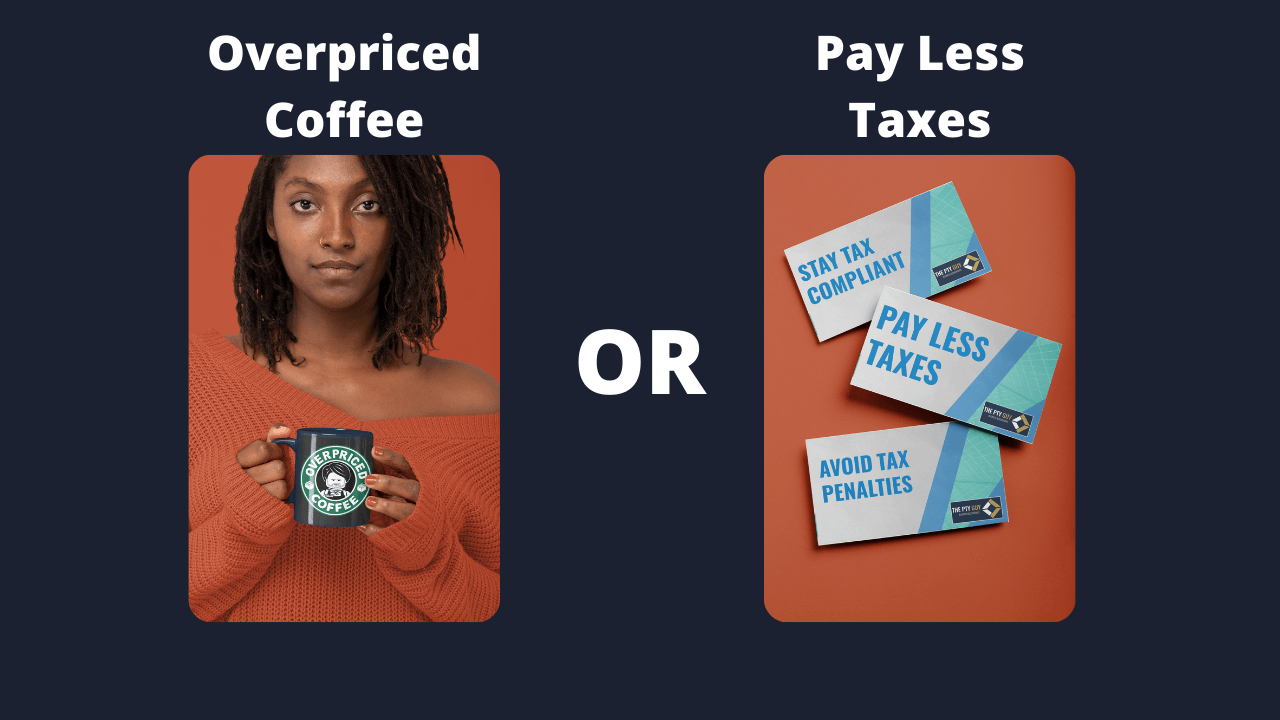

You Decide

How It Works

Step 1. Purchase The Tax Video Mini-Course

You have two payment options: Either pay online with a credit/debit card or via EFT. Both these options are safe and secure.

Step 2. Gain Instant Access To The Tax Video Mini-Course

Awesome...You're now part of The PTY Guy family. After making payment, we will send you an email with a link to instantly access the Tax Video Mini-Course.

Step 3. Watch The Tax Video Mini-Course

You're all set to learn how you can pay less taxes for your business. The course can be watched either from your mobile phone or desktop/laptop.

Frequently Asked Questions

Will these strategies really help my business to pay less tax?

I already have an accountant for my business...Why should I buy your Tax Video Mini-Course? Why not just speak to my current accountant?

The tax strategies that you will learn in our course are overlooked or in some cases not known by the cheaper and less experienced accountants so chances are, your accountant hasn't told you about these strategies. We are not trying to be sensational or "salesy". If, after purchasing our course, you realise that you already knew the strategies we teach or that they were a complete waste of time, then let us know and we will give you a full refund.....No questions asked.

How long is this Tax Video Mini-Course?

What is your refund policy?

Any other questions

Payment Methods

There are two safe and secure methods to purchase our course

Online Via Credit/Debit Card

With this method you can use your credit/debit card to purchase our course. We use PayFast as our online payments platform. This platform is safe and secure.

Via EFT/ATM Cash Deposit

After clicking the button below, you will be prompted to download our banking details so that you can pay for the course via EFT or ATM cash deposit.

Our Branches

Sandton Branch

Atrium on 5th, 9th Floor, 5th Street, Sandton, Johannesburg, 2196

Operating Hours:

Mon-Fri, 08h00 to 16h30

clientcare@theptyguy.com

011 082 9869

Pietermaritzburg Branch

201 Peter Kerchoff Street, Dube House, Pietermaritzburg, KZN, 3201

Operating Hours:

Mon-Fri, 08h00 to 16h30

clientcare@theptyguy.com

033 342 0539